Nigerian Banks Ordered to Report Monthly Transactions Above ₦5 Million Under New Tax Law

In a sweeping fiscal reform, Nigerian banks will now be required to report all customer accounts with monthly transactions exceeding ₦5 million to tax authorities. The National Orientation Agency (NOA) confirmed this directive as part of the newly enacted 2025 Tax Reform Act, signaling a major push for financial transparency and improved tax compliance.

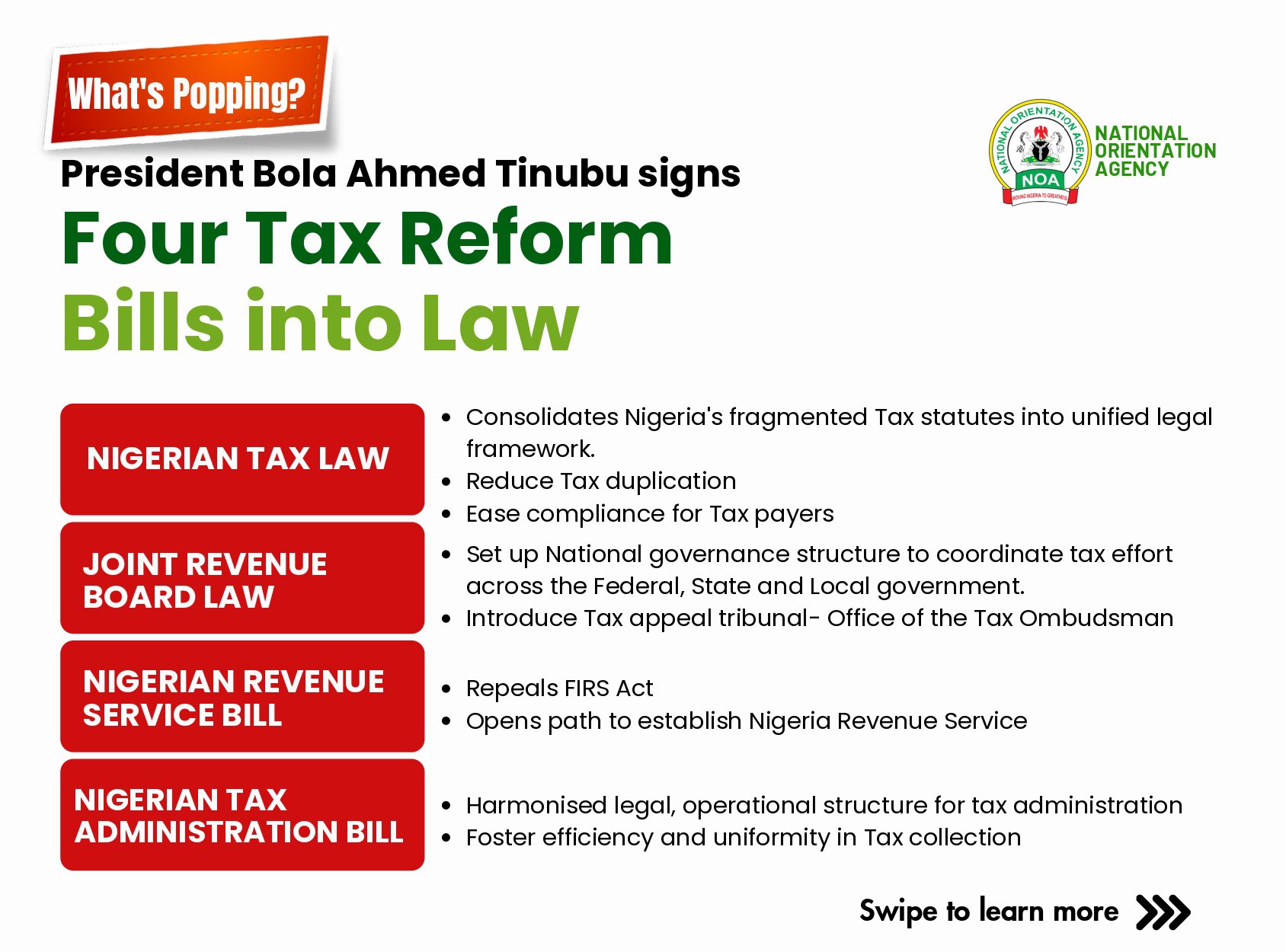

Key Provisions of the Tax Reform

Section 30 of the legislation places commercial banks at the center of Nigeria’s enhanced tax monitoring framework. Financial institutions must now submit monthly reports of high-value transactions to the Federal Inland Revenue Service (FIRS) and other relevant agencies.

The NOA announced this development through its official X (formerly Twitter) account, emphasizing that the measure aims to prevent taxable income from slipping through regulatory cracks. Economic analysts predict this could significantly boost government revenue by capturing previously unreported income, particularly from high-net-worth individuals and the informal sector.

Tax Relief for Low and Middle-Income Earners

While tightening oversight on large transactions, the reform introduces several taxpayer-friendly measures:

- Increased tax exemption threshold: Annual income up to ₦800,000 (₦66,667 monthly) is now tax-exempt, up from ₦500,000

- Capital gains exemption: Section 31 removes taxes on profits from selling a primary residence

- Compensation protection: Section 50 excludes up to ₦10 million in compensation for injury, job loss, or defamation from taxable income

Redistribution of VAT Revenue

The legislation introduces a revised Value Added Tax (VAT) distribution model effective 2026:

| Entity | Allocation | Change |

|---|---|---|

| Federal Government | 10% | Down from 15% |

| State Governments | 55% | Up from 50% |

| Local Governments | 35% | Unchanged |

The state allocation will be distributed as follows: 50% equally among states, 20% based on population, and 30% tied to consumption patterns. This adjustment particularly benefits high-consumption states like Lagos and Rivers, incentivizing subnational governments to boost local economic activity.

Industry Reactions and Implementation

Financial experts have largely welcomed the reforms as a balanced approach to expanding Nigeria’s tax base while protecting vulnerable citizens. The combination of transaction monitoring and revised VAT distribution represents a philosophical shift toward transparency and economic activity-based revenue generation.

However, privacy advocates and banking institutions have raised concerns about data protection. They’re calling for clear operational guidelines to prevent potential misuse of the financial reporting system.

As the provisions take effect in 2026, stakeholders across government, finance, and civil society will closely monitor impacts on:

- Tax compliance rates

- Government revenue collection

- Consumer financial behavior

- Banking sector operations

The success of these reforms could position Nigeria as a regional leader in innovative tax administration, provided implementation addresses concerns about privacy and bureaucratic overreach.

READ ALSO: How new tax law impacts banks’ operations in Nigeria — Analysis

Full credit to the original publisher: Tribune Online